Slack stock (NYSE: WORK) tumbled on Wednesday as potential shareholder lawsuits piled up.

This downward momentum continues a trend from last week when Slack stock got hammered after the company forecast larger Q3 losses.

As CCN reported, Slack expects to lose 8 to 9 cents a share for the third quarter ending Oct. 31. Analysts had estimated a third-quarter loss of 7 cents a share.

Slack Stock Tanks 15% After-Hours Amid Wider Q3 Loss Outlook https://t.co/8mISyRmJUS

— CCN Markets (@CCNMarkets) September 5, 2019

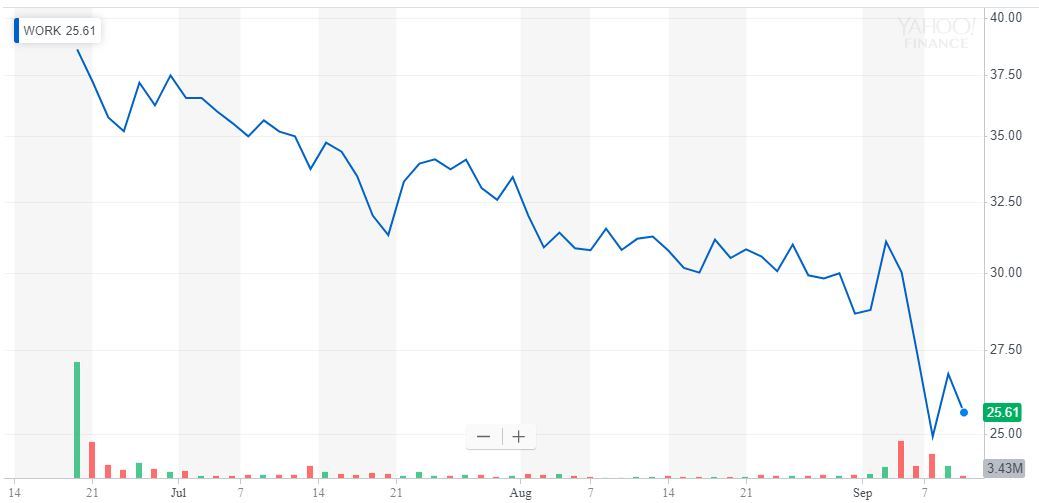

Slack stock has cratered since June IPO

The negative outlook is fueling worries that the work-communications company might operate at a loss for the foreseeable future.

It’s normal for a new public company to remain unprofitable for several years. After all, Amazon consistently lost money for years after it went public.

However, Slack stock’s consistent decline since its June IPO has triggered alarms. On June 20, Slack began trading on the NYSE at an opening price of $38.50 a share.

Since the IPO, Slack has traded as low as $24.92. As of this writing, WORK is trading at $25.57, down 4.4%.

4 law firms circle the wagons

This morning (Sept. 11), a fourth law firm announced that it’s investigating Slack for potential violations of federal securities laws.

Pennsylvania attorney Howard G. Smith is investigating whether Slack misled investors and failed to make adequate financial disclosures. Smith is soliciting investors who lost more than $100,000 to come forward, presumably so he could launch a class action suit.

Last week, the Schall Law Firm in Los Angeles announced a similar investigation on behalf of Slack investors. Specifically, Schall noted that Slack Technologies Inc. admits it’s “forecasting a larger-than-expected loss for the third quarter, leading to a sharp drop in Slack shares over the next two trading sessions.”

Schall revealed that the San Diego law firm of Robbins Arroyo LLP is also investigating Slack’s management and board of directors for potential securities law violations. In addition, another Los Angeles law firm called Glancy Prongay & Murray LLP is considering a potential shareholder lawsuit.

Neither the Smith nor Schall law firms immediately responded to CCN’s requests for comment.

That said, shareholder lawsuits are a dime a dozen. Some are merely shakedowns for money, while many others are legitimate. Only time will tell which is the case when it comes to Slack.

Slack stock unexpectedly spiked 7% yesterday

Interestingly, Slack surged 7% yesterday (Sept. 10), closing at $26.75 on more than double its usual daily trading volume. It’s unclear what drove yesterday’s rally.

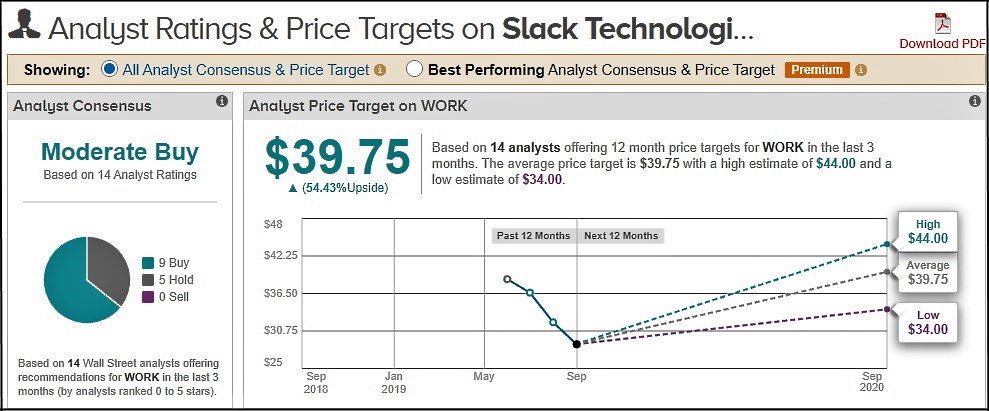

Despite its recent troubles, a Wall Street consensus of 14 analysts rate Slack stock a “moderate buy.”

Moreover, those same analysts have set a bullish average price target of $39.75 a share, with a high estimate of $44 and a low of $34.

Slack is also confident in its future, and has audaciously vowed to replace company email by 2026. So at the moment, it has a fairly bright outlook. But that could change anytime, so stay tuned.

Last modified (UTC): September 11, 2019 3:28 PM