Stocks and bonds now have some stiff competition. American investors are increasingly exploring the idea of adding bitcoin to their investment portfolio, according to a study by Grayscale Investments and Q8 Research. Of the 1,100 U.S.-based investors polled in March and April, nearly 40 percent are interested in owning some bitcoin. According to Grayscale, this “[represents] a potential market of more than 21 million investors in the general population.”

While the typical asset allocation for U.S. investors is 60/40 across stocks and bonds, respectively, that ratio should now expand to include cryptocurrencies. Investors are increasingly hunting returns that are not possible in other asset classes. According to the report:

“A large majority of investors (83%) were strongly motivated by the idea that they could invest small amounts in bitcoin today, see how their investments performed, and add to their positions later. The idea that bitcoin has significant potential for growth and that bitcoin is scarce also resonated with investors interested in investing in bitcoin.”

Fundstrat’s Thomas Lee has touted a 1-2 percent allocation to bitcoin, which given this year’s bull market would bolster most investment portfolios.

If an investor allocated 2% of his portfolio to #bitcoin, this TINY allocation would have added 400bp to his overall return. WOW 😲

Hence, we advise to allocate 1-2% to crypto.

For those who want to avoid crypto wallets, use @grayscale $GBTC and @CoinSharesCo ETN products

— Thomas Lee (@fundstrat) June 24, 2019

In fact, signs are everywhere that investors are increasingly “getting off zero” (as Morgan Creek’s Anthony Pompliano says about institutions) and gaining exposure to cryptocurrencies. Some might be investing in bitcoin to save for retirement.

“I have a fairly nice nest egg of Bitcoin and some alt coins.” Yes, you’ve read that right. We’re way passed the “ls this an investment?” stage, advisors. Crypto portfolios are actually being referred to as a nest egg. Welcome to 2019.

— Tyrone V. Ross Jr. (@TR401) July 25, 2019

Average Joe Is Interested in Bitcoin

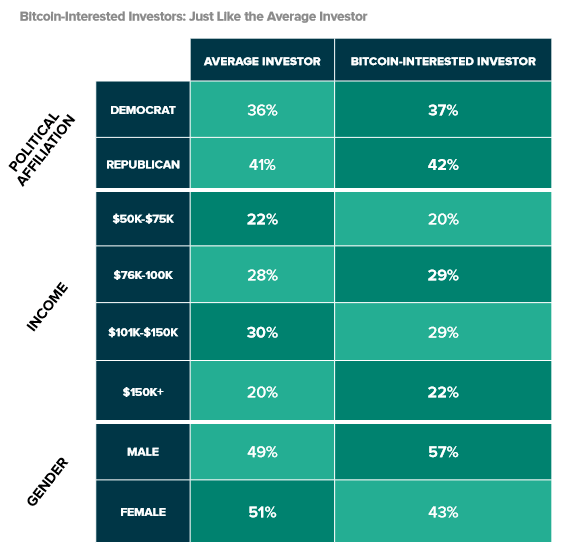

If you’re wondering the type of investor that bitcoin is attracting, it’s just your average Joe, the report suggests. These individuals tend to have a somewhat higher risk tolerance, but that’s understandable given the volatile nature of the asset class. Otherwise, the investors, who tend to be a few years younger than the average stock market investor, span political parties and income levels, with a higher percentage of men (57 percent) showing an interest vs. women (43 percent).

Bitcoin as a Store of Value

Grayscale Investments is behind the ‘Drop Gold’ campaign, so it’s not surprising that they would explore the BTC/gold dynamic. In fact, there is a correlation between those investors who are interested in bitcoin and those who are interested in gold.

Crypto on the Radar

It’s no wonder that American investors are more interested in crypto than ever. Bitcoin has received a great deal of media attention in 2019, and the financial services industry has made it easier than ever to invest in cryptocurrencies, with players such as Fidelity entering the fray.

Merchants are increasingly finding ways to accept crypto, including sports teams like the Miami Dolphins, which recently started taking Litecoin as a form of payment. Showtime’s drama series “Billions” is also expected to incorporate more crypto now that “Bitcoin Billionaires” author Ben Mezrich has joined the show as a writer. With the bitcoin price hovering at $10,000 and bullish predictions for the second half of this year, bitcoin is bound to capture the attention of more Americans.