Financial markets went a little wild in the past week, after the Federal Reserve on Wednesday delivered an unexpected message.

Policy makers penciled in two interest rate increases by the end of 2023 and began talking about the eventual need to slow down the central bank’s monthly asset purchases.

Read: Barclays moves up expectations for Fed tapering after FOMC meeting

But a reading of the reaction across financial markets may be signaling that investors don’t think the Federal Reserve will have room to raise rates very far once the hiking cycle begins, argued George Saravelos, currency strategist at Deutsche Bank, in a Friday note.

But first, how wild was Thursday’s session?

- The ICE U.S. Dollar Index DXY saw its biggest one-day jump since the March 2020 pandemic forced a global scramble for greenbacks as the economy shut down.

- Long-term Treasury yields tumbled to their lowest levels since February as investors snapped up the maturities

- Commodities tanked, with some witnessing their biggest one-day drops since March 2020.

-

The tech-heavy Nasdaq Composite

COMP,

-0.92%

rallied as other benchmarks flagged, ending just shy of a record. The Dow Jones Industrial Average

DJIA,

-1.58%

sank, while the S&P 500

SPX,

-1.31%

suffered a fractional loss.

Short-term yields continued to rise along with the dollar on Friday, while commodities saw a mixed performance and stocks extended losses into the closing bell, albeit with the Nasdaq modestly outperforming its peers.

Saravelos sought to tie it all together.

Dollar rally

Among the individual moves, the dollar rally was the easiest to explain. The move, he wrote, “was entirely consistent with our framework that what matters for the greenback is front-end real rates.” Real rates are yields adjusted for inflation. The short end of the yield curve rose sharply in reaction to the Fed’s shift, while longer maturities fell.

“There should be no surprise that the dollar has rallied strongly even if 10-year yields have not made new highs,” the economist said.

Read: Why the U.S. dollar is soaring — and what’s next — after Fed’s change in tone

Commodity selloff

“The role the Fed has played in inflating commodity prices should not be underestimated,” Saravelos said, noting a “very high” inverse correlation between the dollar and base metal prices. In other words, when the dollar falls, prices rise, and vice versa.

And data has shown an “extremely powerful link” between the Fed balance sheet, commodity prices and inflation expectations, he said, noting that the Fed’s signaling of plans to taper bond purchases in 2013 also marked a peak in inflation expectations. Deutsche Bank economists have also found a high correlation between survey-based measures of consumer inflation expectations and commodity prices, as well.

Long-term bond yields

OK, but what’s the deal with the rally in long-term 10-year Treasury notes

TMUBMUSD10Y,

and 30-year Treasury bonds

TMUBMUSD30Y,

that sank yields? Shouldn’t the threat of a Fed “taper” push yields higher?

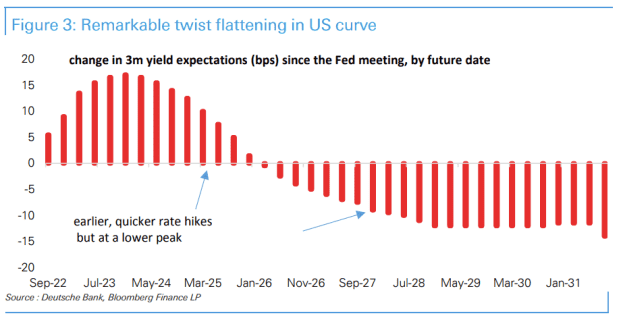

“The market has undergone a remarkable twist flattening over the last 48 hours,” Saravelos said, with yields on Treasurys with maturities out to 2024 rising, while those beyond have gone down (see chart below). It’s also coincided with the drop in market-based inflation expectations.

Deutsche Bank

“This is extremely unusual given that the Fed has not even started hiking rates yet,” Saravelos said.

Follow the star

The market action, he argued, is consistent with a pessimistic take by investors on prospects for what’s known as the natural rate of interest — the real, or inflation-adjusted, interest rate expected to prevail when the economy is operating at full steam. In economic jargon, the natural rate is referred denoted as r*, or r-star.

The market’s message is that if the Fed decides to begin raising rates early, “it won’t be able to go very far before inflation and growth hit a speed limit, pushing yield expectations after the initial hike lower,” Saravelos said.

The pessimistic view on r-star also lines up with market behavior outside of bonds, the economist said.

The dollar’s sensitivity to the smallest shifts in the Fed’s stance reflects pent-up demand for yield from investors. That forces a stronger dollar, which in turn has a bigger disinflationary impact on the economy more quickly than expected, he said.

But for the dollar to see a big “up cycle,” the Fed “needs to be able to get very far. The market is not so sure,” he said.

A low r-star is also in line with a resilient equity market, particularly growth stocks that are more sensitive to interest-rate moves, consistent with a rotation into the Nasdaq.

Saravelos acknowledged that investors shouldn’t read too much into a single day’s price action, but warned that “the market is sending some peculiar signals that need to be monitored.”