The two front-running parties started the week with very similar, widely praised tax announcements. But they quickly returned to offering micro-targeted tax policies that are less clear, less fair and less efficient.

The week began well. Both the Liberals and the Conservatives unveiled broadly based tax cuts for the lowest tax bracket. Both plans were simple, fair and efficient — a welcome departure from years of boutique tax credits that narrowly targeted small groups of voters.

Then, much to the dismay of economists across the country, both parties rolled out a series of very specific, very targeted tax credits:

-

The Conservatives offered up tax cuts that would allow businesses with more than $1 million in assets to shelter money made through stock market investments.

-

The Liberals offered interest-free loans to those renovating their homes to make them more energy efficient.

-

The Conservatives unveiled a $20,000 tax credit for energy-efficient home renos.

-

The Liberals offered $2,000 bursaries to encourage low-income Canadians to visit national parks.

That sound you hear is economists across the country grinding their teeth.

To understand why these boutique tax proposals are so disappointing to policy experts, look first at why the broadly based approaches met with their approval.

Both the Liberal and Conservative broadly based tax proposals targeted the same group of Canadians. Two-thirds of Canadians make less than $46,000 a year; both the Liberal and Conservative plans would apply to that large cohort and reach a huge number of Canadians.

The duelling tax plans took different slightly approaches — the Conservative plan lowered the tax rate in that bracket, while the Liberal plan raised the amount of income that is exempt from taxation. But tax experts on either side of the aisle said they were a step in the right direction.

“[It’s] a fair approach,” said Aaron Wudrick of the Canadian Taxpayer’s Federation. “A simpler approach is preferable to what we’ve seen, which is increasingly micro-targeted boutiques, which … again, are designed for their political impact rather than their policy soundness.”

Broadly based tax policies reach large swaths of the population. Economists say they benefit the most people and let them decide what to do with the money.

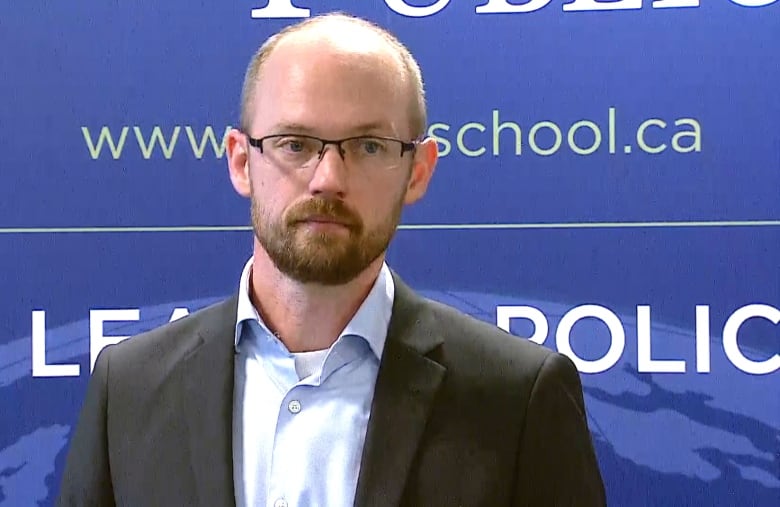

Economist Trevor Tombe of the University of Calgary said he’s a fan of such tax policy precisely because “it doesn’t care how you make your money, where you make it or what you choose to do with it.”

“It leaves those decisions to you, your business and your family,” he said.

Boutique tax gestures, like the ones the parties unveiled this week, “distort decisions and add complexity to the tax code itself,” he said.

Most economists say the best tax policies are simple and easy to understand. They’re good for the bottom line and they make tax filing less of a hassle, renowned tax expert Allan Lanthier said.

Small, targeted tax cuts like the ones we saw this week “significantly increase the compliance cost [for] taxpayers,” Lanthier said. Filers have to find their old receipts for their kids’ art programs or fitness classes, decide whether the new windows they installed meet the new requirements, and send everything off to an accountant in the hopes of getting some money back.

“It adds complexity and costs,” he said. “And it adds a cost to the [Canada Revenue Agency] as well, because they have to process all these claims.”

And yet, such boutique tax cuts have dominated fiscal and tax policies for years.

“Most boutique measures end up being more about their political saleability rather than their policy soundness,” Wudrick said.

There’s a reason parties like boutique tax cuts: they’re easy to sell. People see themselves in those boutique credits and feel like the government is doing something for them. If you have kids in a sports or arts program, you’d welcome a tax credit. If you run a small business, you’re probably cheering for the tax changes proposed by the Conservatives.

But Lanthier said their political utility doesn’t make them good policy.

The return of passive income tax breaks

As an example, he points to the small business tax changes that were hotly debated last year. They were framed as a way of helping small businesses, the biggest source of jobs in the country. But a closer look at of the fine print shows the changes would provide tax shelter to businesses with more than $1 million in so-called “passive investments”.

That’s not investment in new equipment or new mortgages. Passive investments tend to be in stocks or bonds. Less than three per cent of small businesses have more than $1 million in passive investments, meaning these changes would allow just a tiny fraction of Canadian businesses to lowe the tax rate they pay on the earnings those investments bring in.

Today’s @CPC_HQ announcement *brings back* income sprinkling, and allows firms with $1million+ of assets to

shelter their savings in ways not available to other Canadians.

These proposals clearly benefit the highest earners who have private corps.https://t.co/2M15W61esk pic.twitter.com/OvkaVJZXUk

“The stated objective [of the small business deduction], when it was introduced, is to assist small businesses in growing and to create more employment,” said Lanthier. “The legislative objective was not to provide for someone’s retirement.”

“Moving toward something that’s broad-based and simple is better,” said Tombe. “It costs less to administer, it costs us less to comply with and it leaves us to make decisions based on their merits, rather than their provisions in the tax code.”

Tombe pointed out that there’s still a lot of campaign left to go and the campaign to date has seen more actual policy talk than he expected. The parties saw how experts of all stripes applauded the broadly based tax policies while denouncing the boutique measures. So maybe future campaigns will see a shift toward an emphasis on tax policies that are more clear, more fair and more efficient — policies that make the tax code simpler.

Or maybe the 2019 campaign will end up proving that boutique tax measures are here to stay because they work — politically, at least.

Talking points are a public relations tool used by politicians and parties at every level. The intention is to keep politicians on track and ensure the party message sinks into the public consciousness, but some experts say sticking too close to a talking point risks losing the message entirely. 7:32