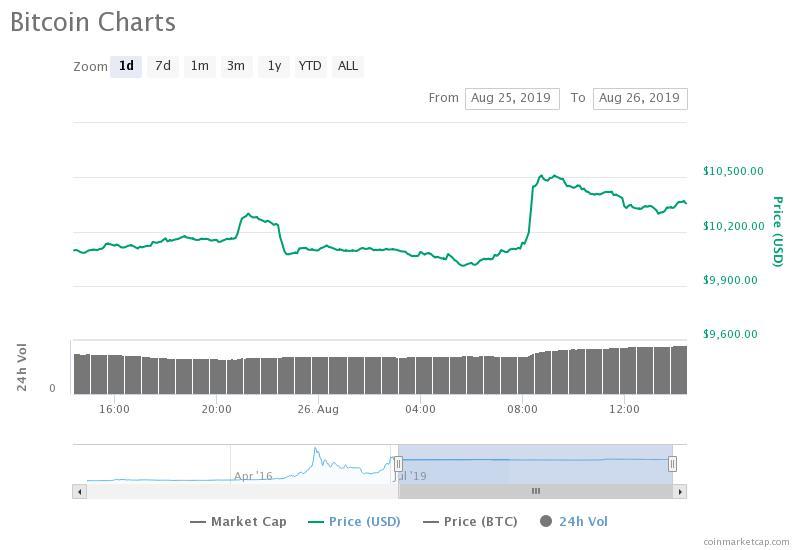

By CCN Markets: On August 28, the bitcoin price flash surged across major cryptocurrency exchanges, rising to as high as $10,800 on BitMEX, the largest margin trading platform for crypto traders based on daily volume.

A large number of shorts were liquidated on BitMEX, triggering buy orders at a higher price, taking the bitcoin price to a key resistance range in $10,800 to $10,900.

Previously, traders like Scott Melker emphasized $10,900 as an important resistance level for bitcoin and indicated that the failure to climb above it could create a difficult market for both bears and bulls.

“This is how I am watching it on the hourly chart. Holding the major ascending support, presently in a small trading range with a likely pennant formed. Red line ($10,900) is key resistance,” Melker said earlier this week.

Too early to say trend reversal for bitcoin

According to DonAlt, a cryptocurrency technical analyst, bitcoin could be demonstrating volatile movements in a large range between $9,400 and $12,000 and has not shown any decisive movement to convincingly direct the market towards a bearish nor a bullish trend.

However, the trader noted that the support range of bitcoin, which was tested five times since mid-July, is weakening and that a move to the low $9,000 region could decide the medium term trajectory of the dominant cryptocurrency in the coming months.

“Closed above mini resistance and immediately dumped off. That’s what I mean when I say choppy conditions. That said it never left the lower trading range, and as long it’s in there short term bias has to be bearish. Support wearing thin here, in my opinion,” he said when the bitcoin price dropped below $10,000 on August 24.

$BTC daily update:

Consolidating in the lower part of the trading range after a false breakout caused by Bakkt FOMO.

That’s bearish to me.

The more time BTC spends down here the more bearish it gets.Bulls need to reclaim 10350 quick otherwise I’ll expect a breakdown. pic.twitter.com/90tc6TuUSW

— DonAlt (@CryptoDonAlt) August 22, 2019

Since then, the bitcoin price has recovered to $10,350, stabilizing following a sudden surge to $10,800. On major spot cryptocurrency exchanges, BTC spiked to as high as $10,650 on the day.

Still, $10,350 to $10,800 remain within the range and until the bitcoin price reclaims $12,000, the analyst stated that it is difficult to call it a convincing trend reversal with the potential of the start to a new bull market.

At what point would it be a proper trend reversal?

For the bitcoin price to indicate the beginning of a strong bull rally, it would have to cleanly break out of resistance found above $12,000 and for BTC to indicate a downward trend throughout September, a move below $9,400 is likely to serve as confirmation.

Technical analysts have described the recent price movement of bitcoin as “choppy conditions,” anticipating large volatile movements and wicks that could fuel more uncertainty in the bitcoin market as to where the asset is heading towards in the medium term.

Click here for a real-time bitcoin price chart.

This article is protected by copyright laws and is owned by CCN Markets.

Joseph Young

Hong Kong-Based Finance and Cryptocurrency Analyst. Contributing regularly to CCN and Hacked. Providing unique insights into the crypto and fintech space since 2012.